I want to charge a tax, but only on the MATERIAL. How do I do that?

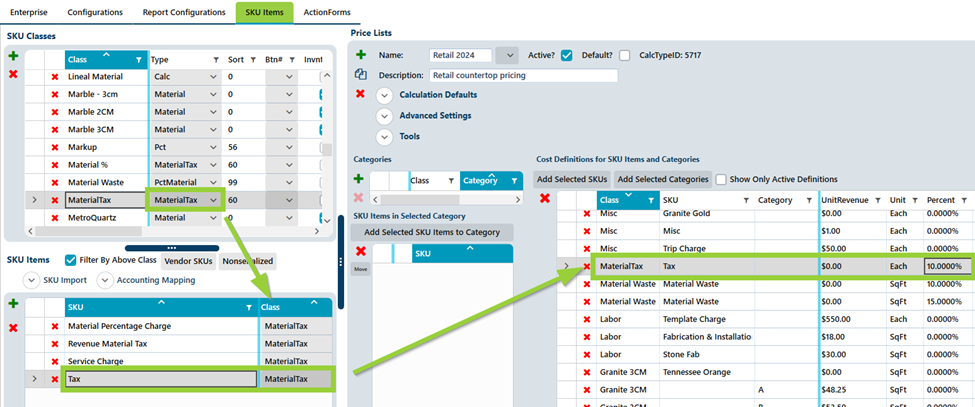

Work with your administrator or account manager to create a class that has the "MaterialTax" type.

Create a SKU item and add it to a price list(s). You will then use the "Percent" column to set the percentage of the material revenue that will be charged as material tax.

When using the Percent column (in the Cost Definitions grid) with the Material Tax SKU class type, the percentage applies to SKU items that are the "Material" SKU class type.

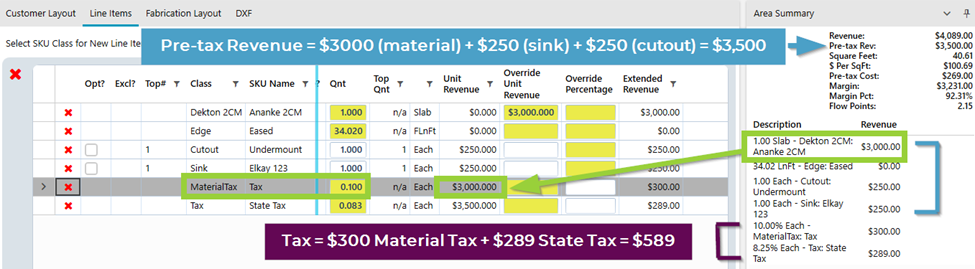

The charge would NOT be included in the pre-tax revenue (not subject to other tax except CC fees).

In this example, the material revenue is $3000, so the 10% material tax is $300. This is NOT included in the pre-tax revenue ($3,500) so the material tax and state tax total is $589, bringing the revenue total to $4,089.

If you would like the percentage to apply to the COST instead of the revenue of the material items, check out the feature here.

Topic Participants

Grace Hunt

Kim Davis